Data Insights on Local Business Performance: +11% Despite Pandemic

While no one would want to go through 2020 again, we can say that from a marketing perspective it was at least interesting for its disruption.

The world naturally embraced e-commerce, while at the same time people cried out for social interactions and made a stand to support local.

But How Has Local Commerce Overcome the Pandemic So Far?

In our new study on The Changing Face of Local, we analyzed nearly 80,000 mid-market business locations across the US and EMEA. We wanted to know whether consumers still used the local assets of a brand (i.e. the store) and to what extent.

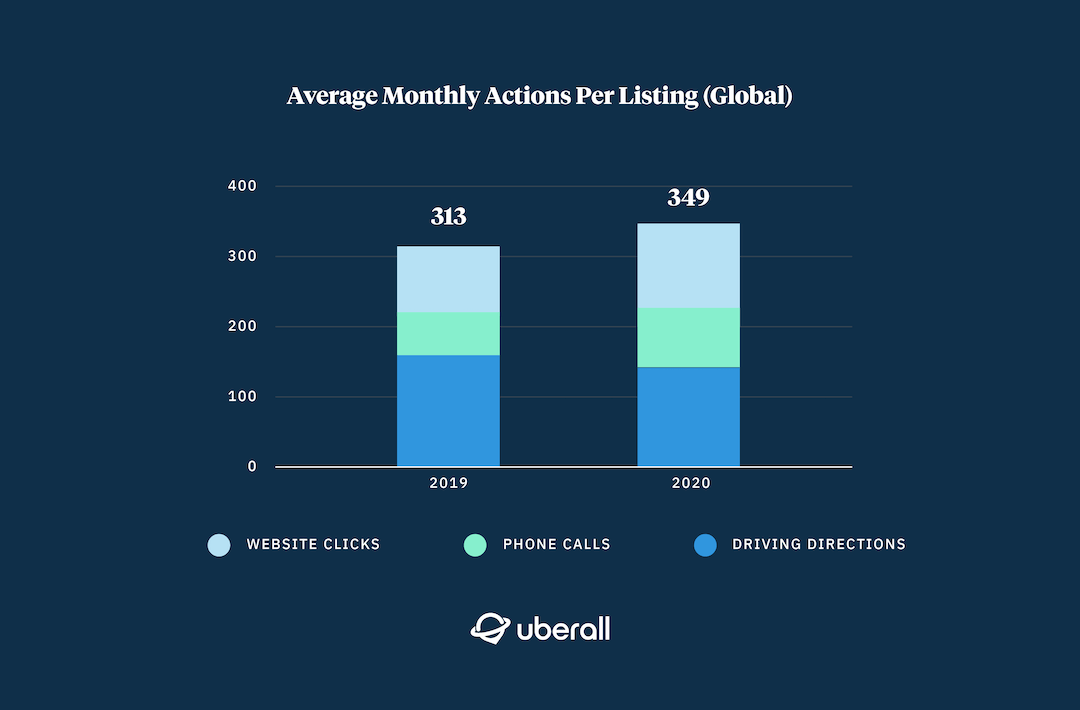

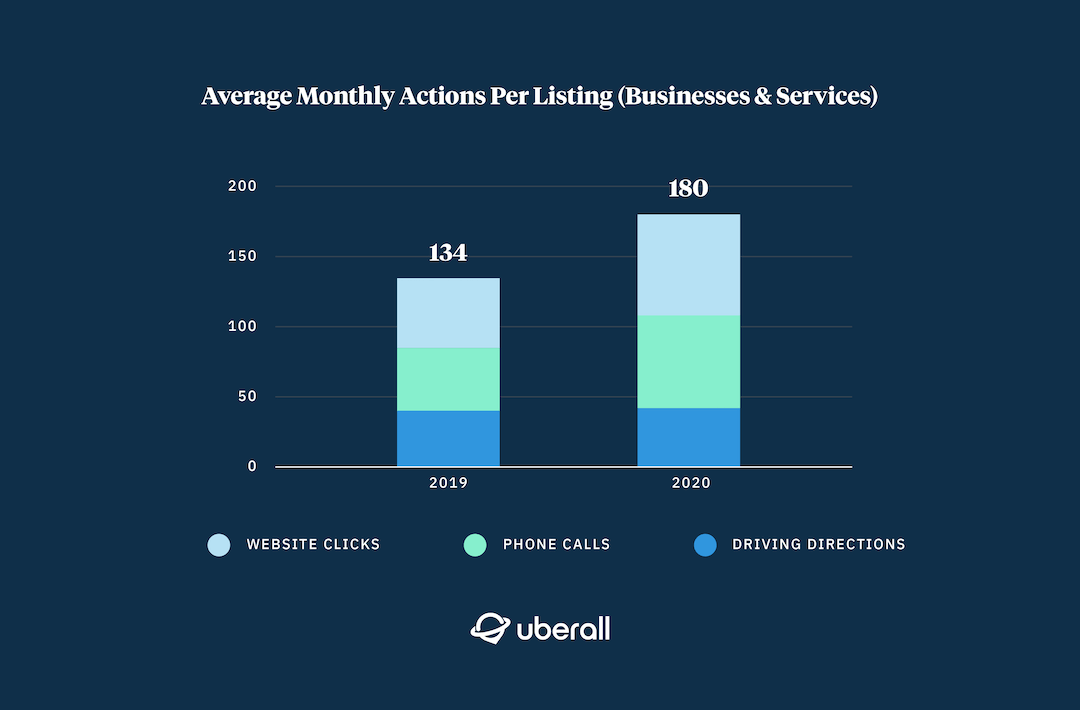

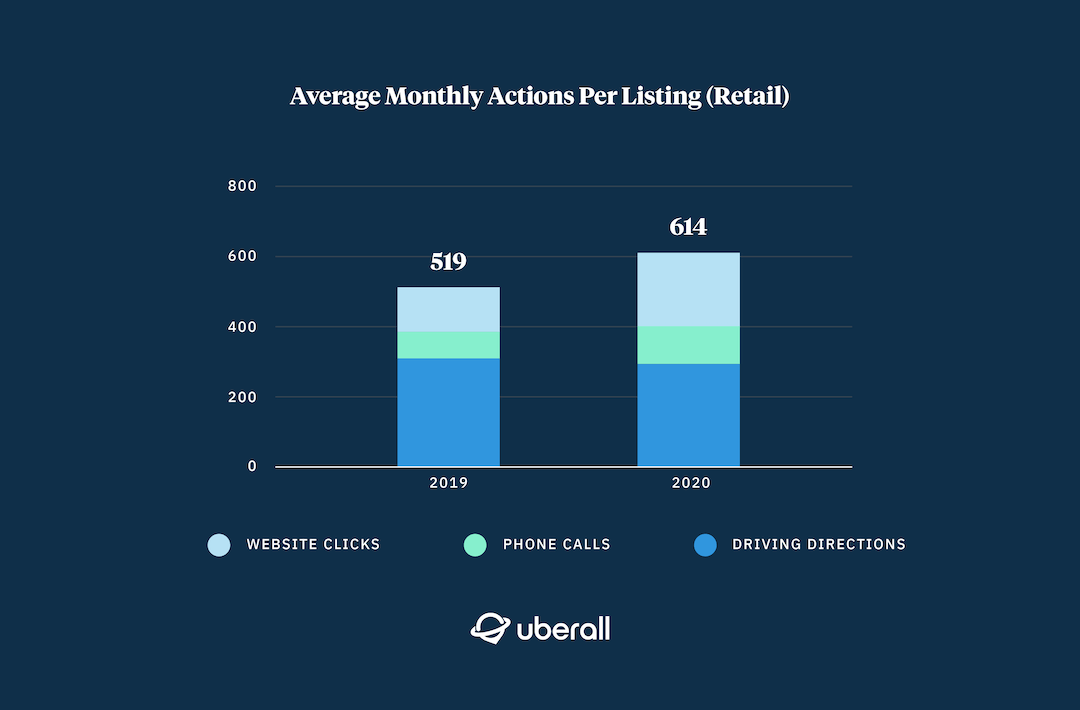

For our analysis, we focused on the local engagements a consumer could take with a business’s listing on Google My Business – represented in clicks on directions, websites, and phone calls.

Those local engagements are an interesting marketing metric for two reasons. They do not only show how consumers want to get in touch with a business but also act as a proxy to the actual conversion – a click on direction leads to a store visit, a phone call leads to a booking, etc.

During our analysis, local engagements were a helpful metric to gather some striking findings that we are happy to share with you.

Get data and insights on changing consumer behaviour in our report The New Face of Local

Key Finding #1: 35% More Clicks on Websites and Phone Calls During COVID

When the pandemic added a new reliance to ecommerce, we first assumed that this would dramatically impact local buying behavior.

On the one hand, it did. However, local businesses have been affected differently, mostly depending on their market and industry. We’ll come to the latter point later.

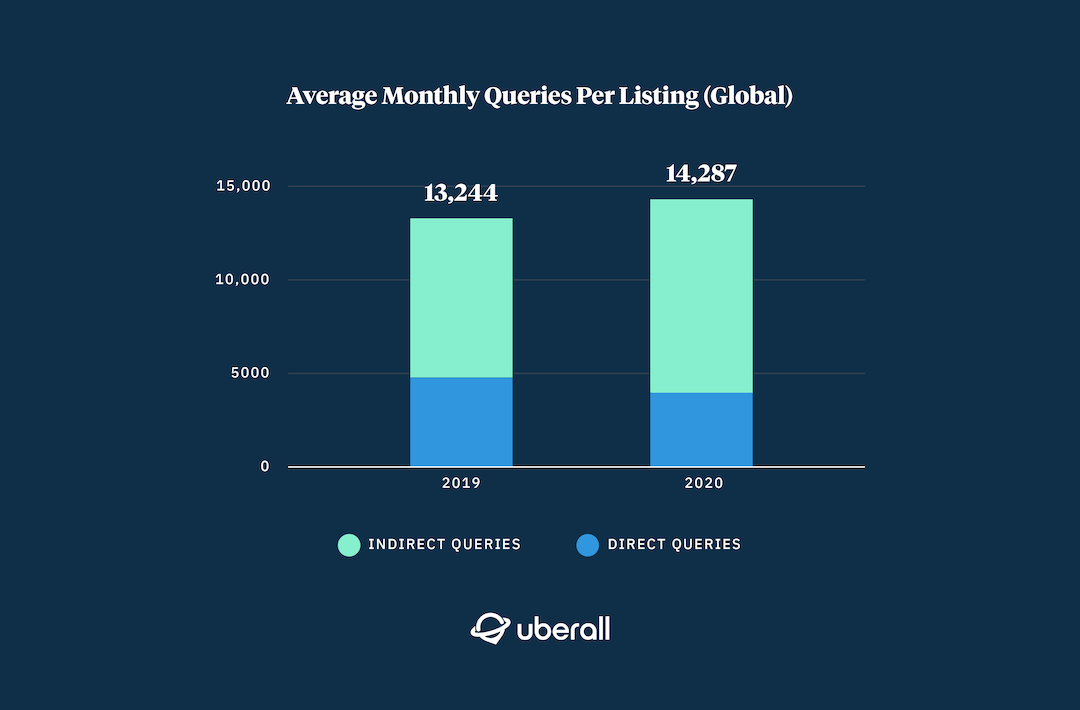

On a global level and without respect to industries, we can see that on average, local businesses have been searched for more often in 2020 than in 2019.

However, indirect queries became more dominant, meaning that consumers searched for the what (“bookshop near me”), not the who (e.g. “Waterstones near me”). Even though direct queries were reduced in 2020, we can already see that consumers wanted to find out more about businesses nearby.

A more interesting change is visible in the local engagements.

Despite the pandemic, consumers converted 11% more often in 2020 than in 2019 by clicking on directions to a business location, calling it directly, or visiting its website. On average, one listing had 349 of those clicks per month, which is 4.188 clicks in a year.

However, the types of engagements have shifted.

In 2020, consumers couldn’t engage as they would have done in 2021. As a consequence, they sought alternative, and safer, ways to find information.

Given that context, it is not really a surprise that direction clicks decreased as visiting a business location became less likely in 2020. Instead, consumers used more phone calls and click on websites. Together, these two categories grew by 35%.

Key Finding #2: France and UK Grew Local Engagements by 42%, While Germany and US Remained Stable

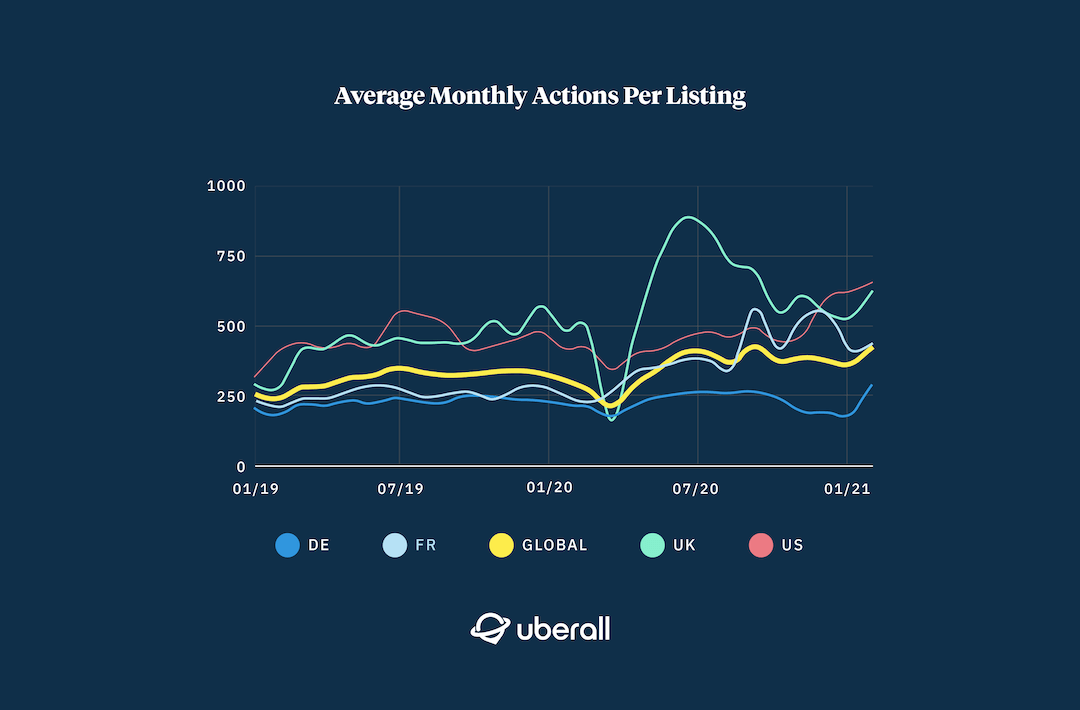

To better understand how local engagements developed in different markets, we first compared them to the global average of local engagements. For an overview, see the graph below:

The graph indicates that consumers in the US and UK have engaged more with local businesses online – their actions are above the global average.

In France, interactions grew significantly in 2020 and went above the global average. Only Germany remains rather conservative, yet resilient. The beginning of the pandemic in March 2020 didn’t strongly affect the average clicks in Germany.

In the UK, however, the break for this is remarkable – and so is the relapse over the summer when people started consuming even more.

If we compare 2020 to 2019 for these markets, local engagements grew by 42% for both France and the UK. Germany (+3%) and the US (-1%) remained stable.

Overall, these insights suggest that for all markets, local online engagements gained more relevance for businesses and consumers. The only change has been the way consumers interact with a business – in 2020 they used safer ways to get the information they needed.

This graph also cautiously indicates some good news we find worthwhile sharing.

In the first quarter of 2021, consumers engaged even more with local businesses, making a decent promise that this trend will continue.

>>> Would you like to discover more about how engagement types (directions vs website clicks vs phone calls) changed in Germany, France, the UK and the US?

Download the report on The New Face of Local to get more insights

Key Finding #3: More Engagements for Those Industries That Digitalised Their Offerings

Every business has been affected differently by the pandemic, and of course, the same goes for every industry. There seems to be a pattern though as to which industries could grow their local engagements and which ones couldn’t – more on that in a bit.

Among those industries that increased local engagements are

- Retail: +18% local engagements

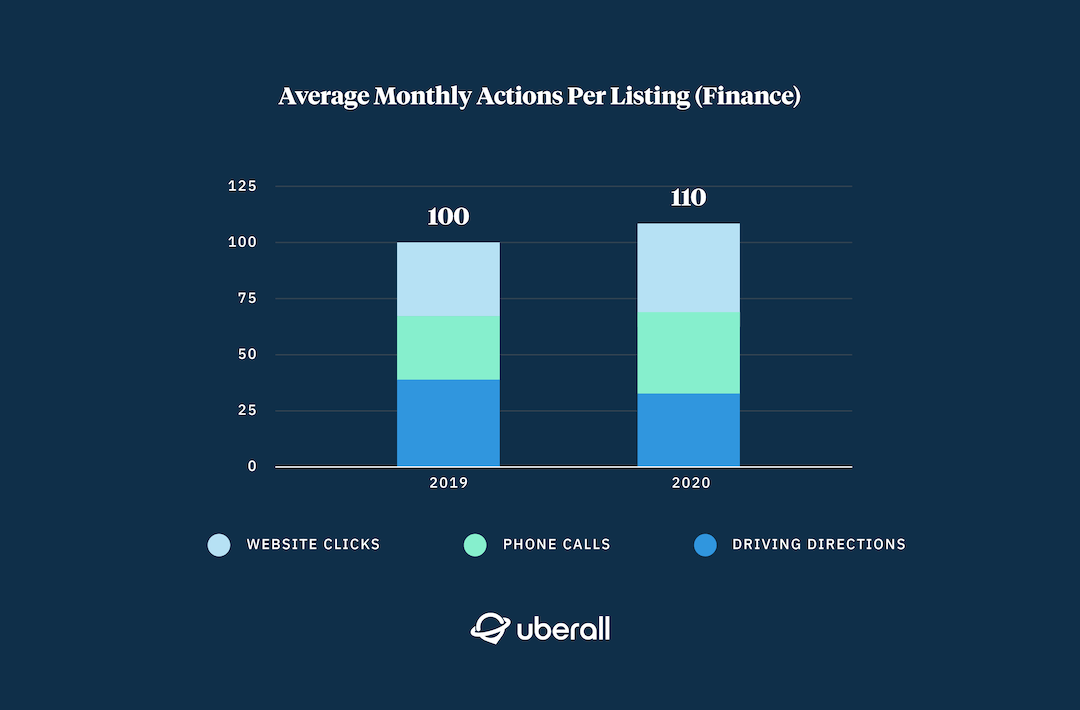

- Finance: +10% local engagements

- Businesses & Services: +34% local engagements

- Community & Government: +93% local engagements

The extreme growth for community & government is likely due to the increased need to find COVID-related information, e.g. regarding regulations, test centers, etc.

Retail, finance, and businesses & services grew as consumers made use of safer ways to engage locally. Clicks on websites and phone calls increased, while clicks on directions remained more or less stable (they didn’t even significantly decrease).

On the downside, industries for food, travel, or social & entertainment weren’t able to grow in 2020. Their local engagements decreased for almost all conversion types, mainly for one reason:

Their offerings are strongly connected to real-life experiences. And in many cases, they couldn’t substitute this experience by a website visit or a phone call.

It’s ok to be cautiously optimistic

The industries that, according to our data, suffered most during the pandemic were also those industries whose local engagements were above the average before the pandemic.

This suggests that these “fun” industries were more relevant to consumers before. As regulations relax and we start to think about our leisure again, it’s safe to expect that fun will have its comeback.

For detailed stats on even more industries, download our report The New Face of Local.

There’s a New Era of Marketing Ahead and It’s Hybrid

Overall, the insights from our new report show that the face of local has changed.

Consumers today have a multitude of options at hand to engage with a business. And they take the option that is most convenient to them at that particular point in time when they are ready to buy.

Our data on local engagements confirms this. It shows a general interest in the local business with a shift towards online or phone conversions in a time when store visits aren’t possible.

This also means that …

The online presence of local businesses is still an essential part of the customer journey, regardless of whether consumers convert online or offline.

There are more insights in our new report that point out how the customer journey has become more hybrid.

To find out more, download our new report The New Face of Local.

Want to level up your hybrid marketing game post-Pandemic? Let us help you!